Gifts of Real Estate

Real estate represents a significant portion of wealth for many individuals and families. Real estate is a great charitable giving vehicle, and a variety of planning techniques can make charitable gifts of real estate financially appealing to donors. But, as an asset class, real estate tends to be illiquid and presents other planning challenges as well. Donors should discuss their options with their trusted professional advisor to optimize tax and financial benefits and mitigate potential risk associated with their gift.

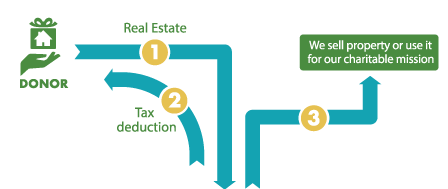

How It Works

- You deed your home, vacation home, undeveloped property, or commercial building to your favorite charity.

- You may continue to use the property rent-free, and then ownership passes when you no longer need it.

- Your favorite charity may use the property or sell it and use the proceeds.

- NOTE: Some nonprofit organizations cannot accept non-standard gifts such as real estate. Please contact the Valley Community Foundation to receive assistance in facilitating this transaction in support of your favorite charity.

Benefits

- You receive an income tax deduction for the fair market value of the real estate.

- You pay no capital gains tax on the transfer.

- You can direct the proceeds from your gift to a specific charity.