Retained Life Estate

Your home is your biggest asset, but did you know you can use it to make a gift to us and still live there?

How It Works

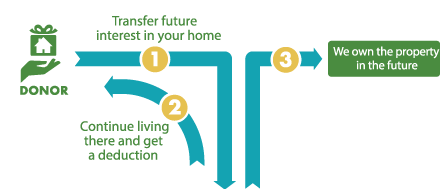

- You transfer the title to your residence, farm, or vacation home to your favorite Valley charity and live there for the rest of your life.

- Continue to live in the property or use it for life or a specified term of years, and continue to be responsible for all taxes and upkeep.

- The property passes to your favorite Valley charity when your life estate ends.

Benefits

- You can give us a significant asset but retain the security of using your property for the rest of your life.

- You receive an immediate income tax deduction for a portion of the appraised value of your property.

- You can terminate your life estate at any time and may receive an additional income tax deduction OR you and your favorite Valley charity may jointly decide to sell the property and prorate the sale proceeds.